|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recovery Vehicle Insurance: Coverage Guide for Peace of MindExploring recovery vehicle insurance can be a smart move for U.S. consumers looking to protect themselves from unforeseen repair costs and enjoy peace of mind on the road. This type of insurance ensures that if your vehicle breaks down, you won't be left stranded. Instead, a recovery service will help you get back on track quickly and affordably. What is Recovery Vehicle Insurance?Recovery vehicle insurance, often referred to as breakdown cover, provides assistance in case your car suffers a mechanical failure. It's like a safety net that helps you manage unexpected situations with ease. Key Benefits

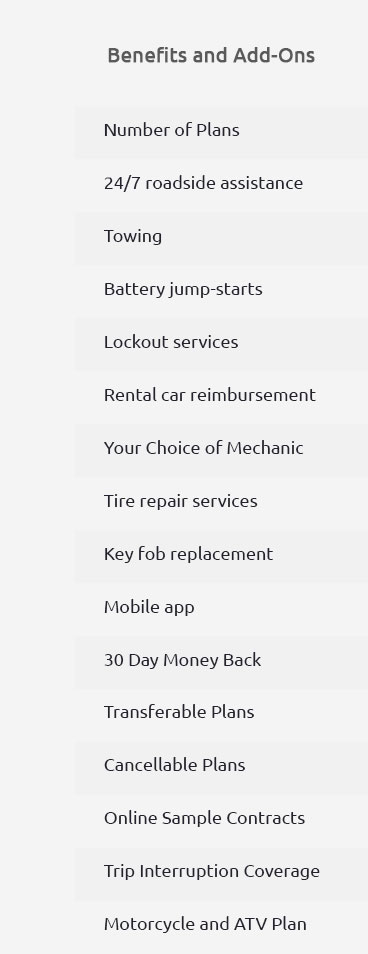

Coverage DetailsWhile coverage options vary, most recovery vehicle insurance plans offer a range of services to suit your needs. Typical Services Included

For those in California, understanding the specifics of what's covered can help you choose the right plan. Consider checking out car warranty companies in california for localized options. Extended Auto WarrantiesExtended auto warranties can complement recovery vehicle insurance by covering repair costs that arise from mechanical breakdowns. They often include parts and labor, offering further financial protection. Why Consider an Extended Warranty?

For a more comprehensive protection plan, consider looking into bumper to bumper auto insurance which can offer extensive coverage for your vehicle. FAQsIs recovery vehicle insurance necessary?While not mandatory, it offers peace of mind and financial protection from unexpected breakdowns. How much does recovery vehicle insurance cost?Costs vary based on coverage level, but plans are typically affordable and offer significant savings during breakdowns. Can I use recovery vehicle insurance anywhere in the U.S.?Most plans provide nationwide coverage, ensuring help is available no matter where you travel. https://www.towtruckinsurancehq.com/recovery-truck-insurance-coverage/

Most recovery fleets are comprised of a many types of vehicles. Underlift wreckers, flatbeds, single axle, double axle, triple axleyour recovery insurance ... https://www.americaninsuranceid.com/auto-recovery-insurance

We offer complete insurance packages with specialized coverage forms designed to protect every aspect of your business. https://www.bollington.com/motor-trade-insurance/recovery-operator-insurance

Recovery operator insurance sometimes known as breakdown and recovery agent insurance is specifically designed to cover those who recover or repair ...

|